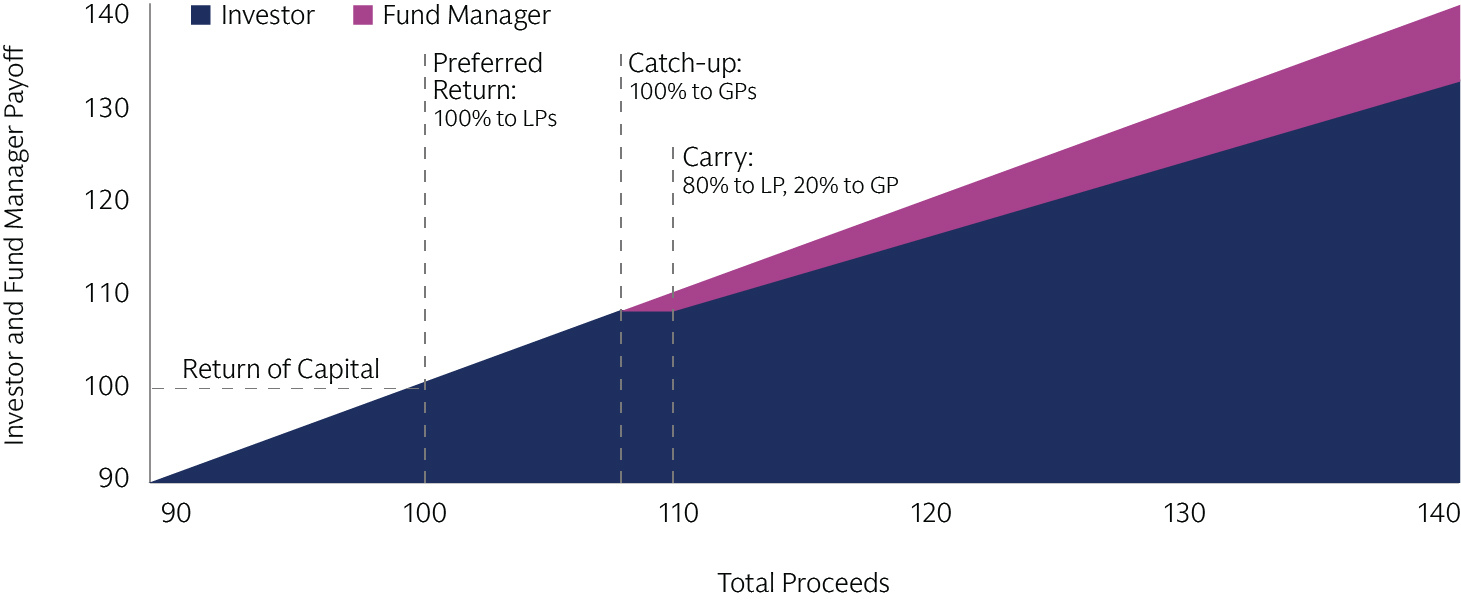

Why Investors are Expanding Beyond the 60/40

Stephanie Richards, Head of Third Party Wealth Alternatives in EMEA, discusses some of the reasons behind the growing investor interest in alternative investments and why more individual investors may consider incorporate alternatives into their portfolios today.