What is Infrastructure?

Infrastructure is the backbone of our society, comprising assets that provide services essential to our lives. The scope of infrastructure is undergoing a profound transformation, as the ways we live, move, and communicate evolve. The modern infrastructure landscape can be classified across four key segments: energy & utilities, transport & logistics, digital assets, and circular economy & other services.

Infrastructure strategies encompass a wide variety of opportunities across the risk and return spectrum. They can offer a combination of income and long-term growth, depending on the underlying approach.

Potential Reasons to Invest

1. Resiliency, with Potential Inflation Protection

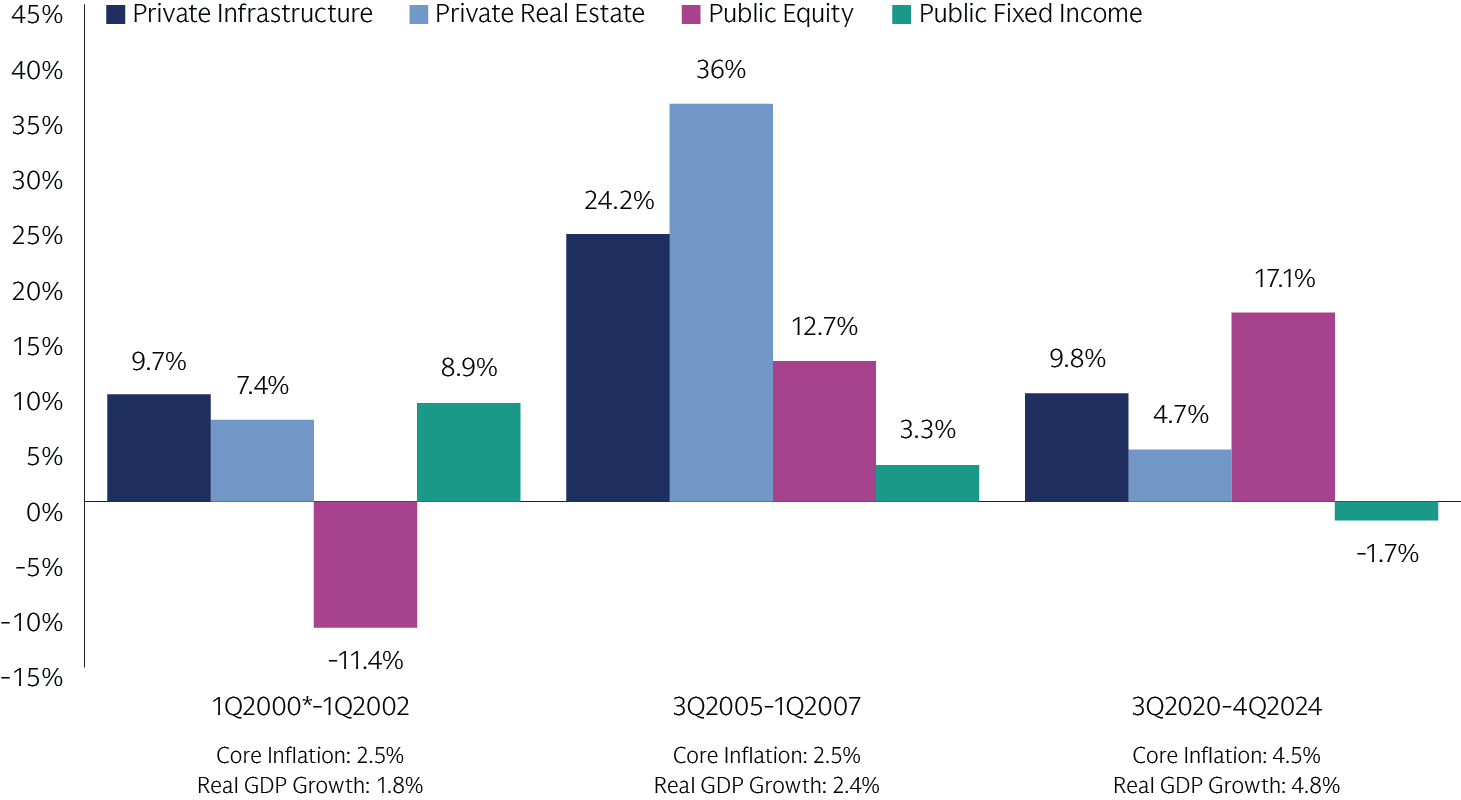

Infrastructure companies have a distinct business model not typically found in other asset classes. The services they provide are essential, and the number of competitors is limited by regulatory and/or physical constraints. Many assets feature long-term revenue contracts, often with price escalators explicitly tied to inflation. Together, these factors make for sticky customer bases, resilient cash flows, and inflation protection. In the most recent inflationary environment, infrastructure yields rose with, and above, inflation levels.

Annualized Asset-Level Returns During Periods with Core Inflation Exceeding 2.5% YoY Since 2000

Source: Burgiss (private infrastructure and real estate), S&P 500 (public equities), Bloomberg Barclays (public fixed income) and BLS (inflation; year-over-year increase in CPI ex-food and energy), as of December 31, 2024. EDHEC Infra300 index for private infrastructure in 2Q2000-1Q2002 due to limited data coverage in Burgiss. Indices are unmanaged and do not include fees. Private infrastructure is not traded on an exchange and will have less liquidity than public entities. Past performance does not guarantee future results, which may vary. High-inflation regimes defined as those where CPI was at or above 2.5%. First data period starts from April 2000 due to data availability for private infrastructure.

2. Differentiated Returns

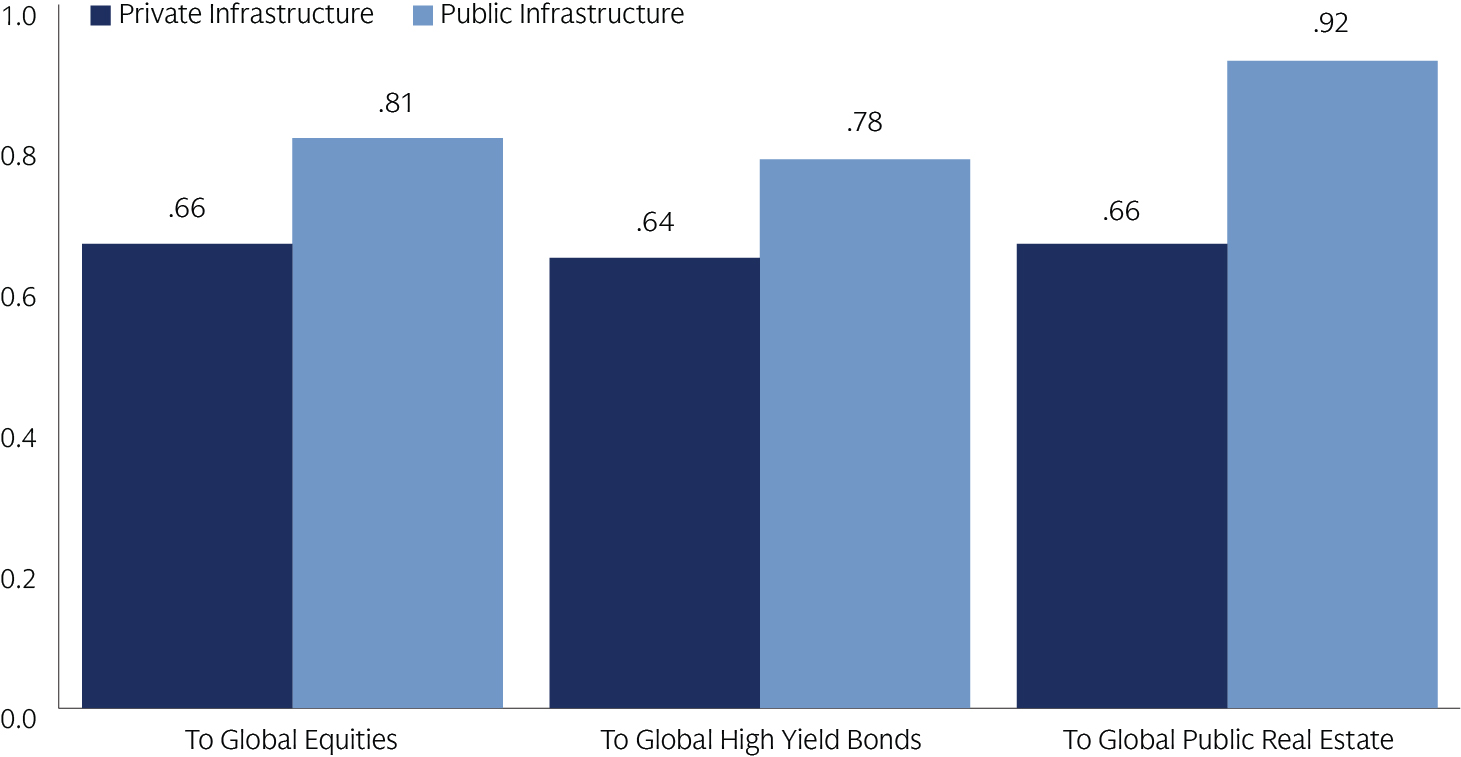

The defensive nature of revenues for many infrastructure assets makes them less sensitive not only to economic cycles but, by extension, to macro-driven equity and credit market movements. The asset class has offered differentiated returns relative to equities and fixed income, with private infrastructure, in particular, offering lower correlations to traditional asset classes. Given these differentiated returns, adding private infrastructure to a portfolio of traditional asset classes can enhance the portfolio’s risk-adjusted return profile.

Infrastructure Correlation

Source: Cambridge Associates (private infrastructure), MSCI (MSCI World, global equities), Bloomberg (Bloomberg Barclays global high yield), FTSE (FTSE EPRA NAREIT, global public real estate), FTSE Global Infrastructure index (public infrastructure). Based on 15 years of quarterly data through 2024. Past performance is not indicative of future results.

3. Capitalizing on Secular Megatrends

Secular megatrends are driving waves of innovation, redefining the way we live, work, and communicate. As the backbone of our society, infrastructure supports and services the tools of transformation by delivering critical energy, communications, and logistics services. As such, infrastructure provides investors unique ways to gain exposure to these structural growth drivers.

Sources: 1. GS Investment Research; FactSet; World Bank; Cisco; company websites. Assumes a PUE of 1.58 based on 2023 global average, and $10 million per MW of construction cost. 2. Goldman Sachs Global Investment Research (Oct 2021); 3. The Climate Policy Initiative has estimated this figure to be as high as $4.1 trillion minimum investment annually by 2030 (Climate Policy Initiative, “Global Landscape of Climate Finance 2021. 4. Bloomberg NEF; IHS trade data; Global Outlook for Air Transport – IATA. 5 World Bank, Fouquin and Hugot (CEPII 2016) – processed by Our World in Data; United Nations World Population Prospects 2024

Certain infrastructure investments may be exposed to regulatory risks and there may be the possibility that that legislative changes can affect partnerships and pricing structures. In addition, some infrastructure funds can be illiquid and typically cannot be transferred or redeemed for a period of time.