What are Secondaries?

Secondary investors buy existing ownership stakes in private market assets from other investors. Assets transacted can range from a single company in a transaction alongside the General Partner to an entire portfolio of funds in a transaction sold by a Limited Partner who owns stakes in the funds.

Secondaries activity has steadily risen over the past decade as the strategy is increasingly embraced by leading institutional LPs and GPs and as an effective portfolio management tool for investors who are overallocated to private markets or wish to consolidate their manager relationships. As the market has expanded, it has become diversified across underlying strategies, from buyouts and venture capital to real estate, infrastructure, and private credit. As the range of transaction structures has expanded, secondary firms have evolved to become providers not just of liquidity but of bespoke capital solutions to GPs and LPs.

Potential Reasons to Invest

1. Opportunity to Acquire Assets at a Discount

Secondaries investors provide liquidity to primary investors in illiquid assets. This liquidity has value for the sellers; accordingly, secondary assets typically transact at a discount to their net asset values. Purchasing partnerships interests at a discount can be a source of returns beyond the value creation made in the underlying asset. The discount varies over time based on the quality of the underlying portfolio and market conditions, and may be especially wide in times of market stress. The ability to create value by executing a complex transaction can also enhance return in this strategy.

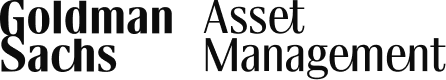

Secondary Market Pricing as % of NAV

Source: Jefferies, “2024 Global Secondary Market Review”, as of January 2025, data on global secondary activity.

2. Accelerated, Diversified Exposure

Since secondary funds buy interests in existing funds, they offer investors private assets exposure diversified by vintage year, strategy, industry, fund manager and geography, among other factors. By providing investors with exposure to more mature private asset portfolios, secondaries funds are typically able to return capital more quickly than a typical drawdown private equity investment fund. Secondary funds also provide exposure to prior vintage years – a benefit that is especially valuable to newer private markets programs or those in ramp-up mode. Evergreen private markets funds likewise offer accelerated, diversified exposure; however, unlike evergreen funds, secondary funds do so without a liquidity sleeve that acts as a drag on returns.

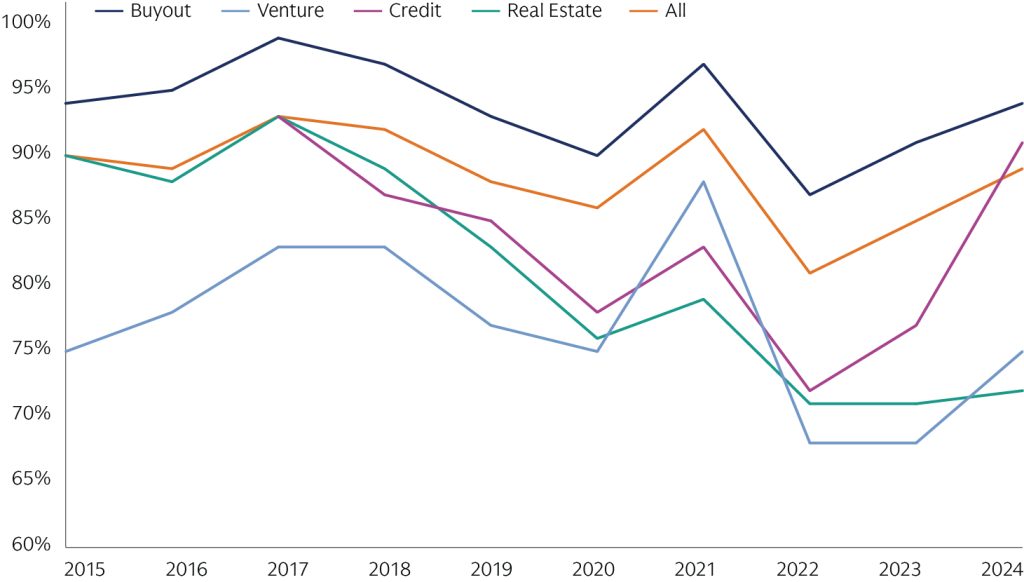

Secondaries vs. Primary Buyout Fund Cumulative Net Cash Flows as % of Commitment

Source: Cambridge Associates, as of Q4 2023. Average across funds of vintages 2000-2019.

3. Risk Mitigation

Because secondary funds invest in existing privately-owned assets, they are able to mitigate some of the risk of primary funds, in which investors commit to new partnerships that have not yet started investing at the time of commitment. Secondaries can mitigate “blind pool risk” – the risk that comes from not knowing which assets will ultimately be in the portfolio. As part of the process of diligence and transaction negotiation, the secondaries manager diligences and values underlying assets. This gives the manager an opportunity to reprice assets for both investment-specific considerations and the overall macro / market environment, in order to target an attractive rate of return. Pricing can also consider the health of the underlying fund’s investment organization, evaluating how organizational factors may impact investment outcomes in the future.

Historically, secondary funds have enjoyed lower loss ratios than primary funds across a variety of strategies.

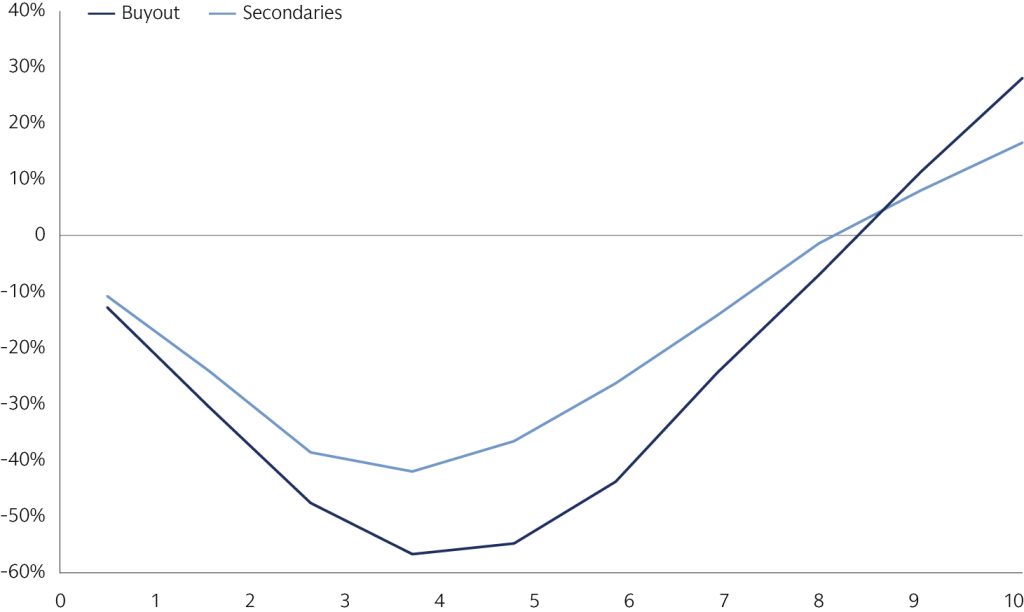

Percentage of Funds Below Cost: Primary vs. Secondary Funds

Source: Preqin. As of February 25, 2025. Includes funds in vintages 2000 to 2019 globally with latest performance reported on a track record of at least 5 years. Data on primary funds for each asset class except Secondaries. Past performance is not indicative of future results