Alternative investment fee structures differ from public markets and have nuances depending on the investment vehicle – drawdown fund or evergreen fund. The attached provides an overview of when and how funds collect fees.

Private Markets Fee Structures – Drawdown Funds

Management Fee

Fees charged on the assets managed. A common fee structure is to charge fees on the committed amount during the course of the investment period, then switch to fees on the amount invested (cost basis of assets remaining in the portfolio). Some strategies charge on the amount invested from the outset. Funds may also decrease the fee rate (step-down) after the investment period. Management fees are not charged on any value appreciation in the fund.

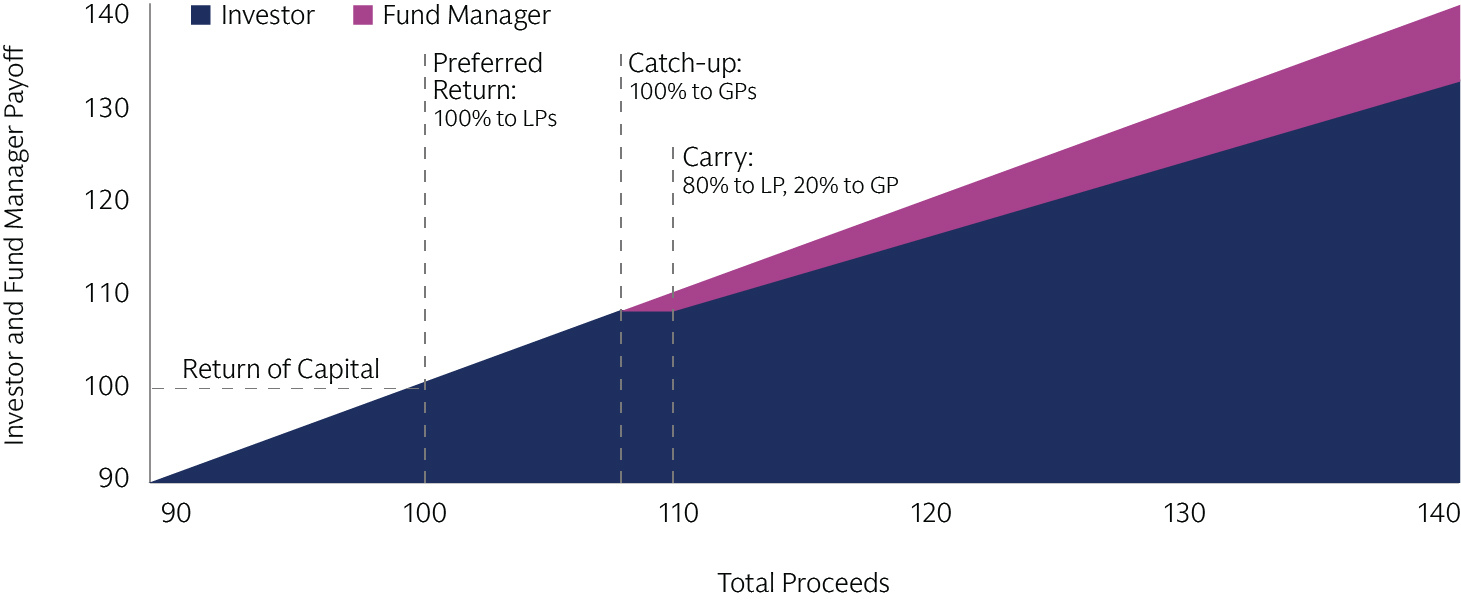

Carried Interest (Carry)

Performance fees, paid on the realized (distributed) value appreciation of assets in the fund. Typically, these are charged only after a preferred return threshold has been met. Carry may be charged either on a deal-by-deal basis or for the overall fund’s performance.

Preferred Return (Hurdle Rate)

The minimum return that the fund must achieve for investors before it can start collecting carry. Many fee structures include a GP catch-up provision, wherein once the preferred return is reached, distributions are allocated to the GP until they equal the carry rate on all distributions to-date. Thereafter, distributions are allocated to GPs and LPs proportionately, based on carry levels (e.g., 20% to the GP and 80% to the LP in case of 20% carry).

Private Markets Drawdown Fund Performance Fee Structure

For illustrative purposes only. Source: Goldman Sachs Asset Management as of March 31, 2025.

Evergreen Private Markets And Hedge Fund Fee Structures

Management Fee

Fees charged on the assets managed. Management fees are typically charged on the Net Asset Value of fund assets throughout the life of the fund. Net Asset Value includes the original investment cost basis plus appreciation of assets in the fund.

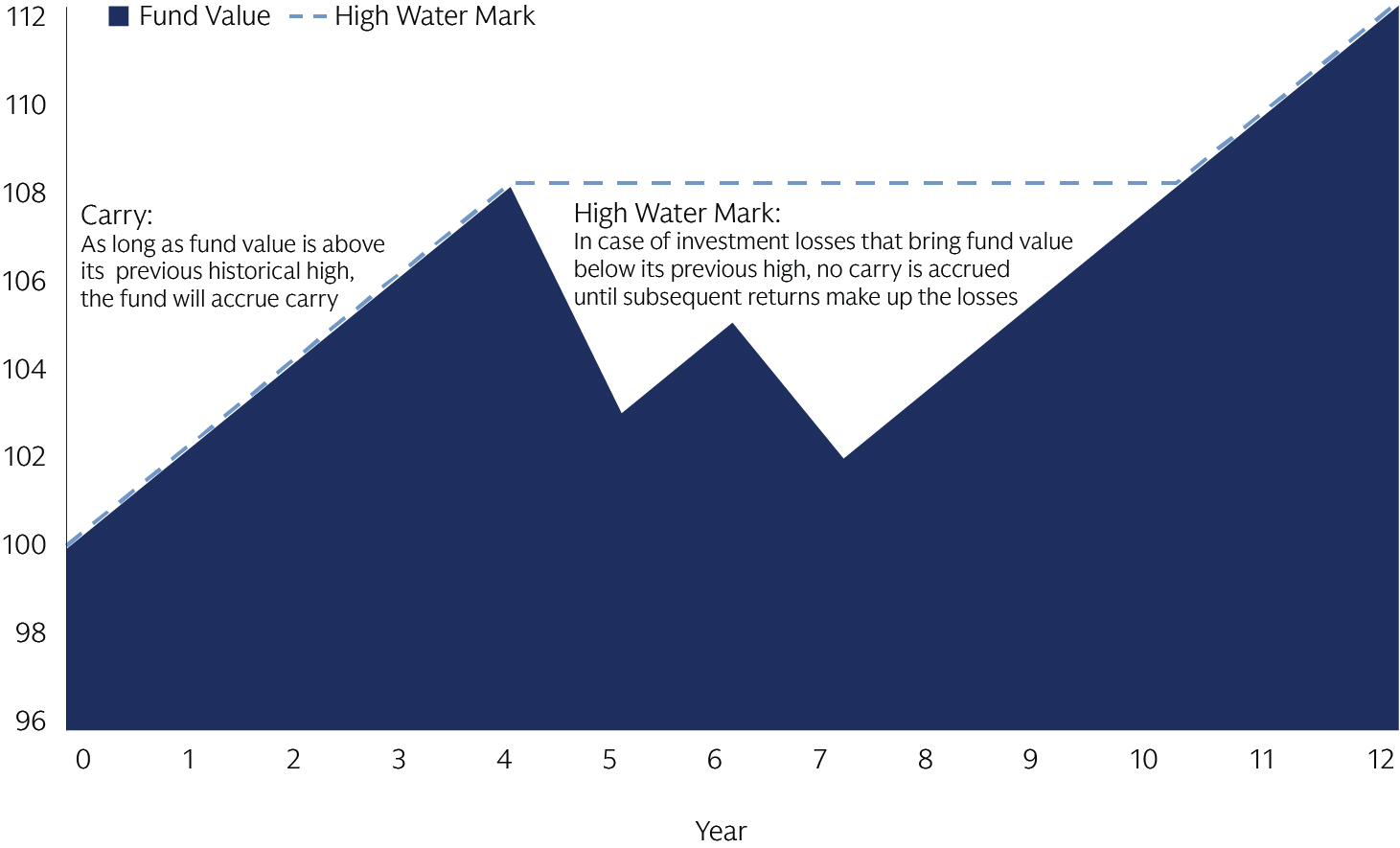

Carried Interest (Carry)

Performance fees, paid on the value appreciation of assets in the fund. Carry is typically charged annually based on the total return (NAV appreciation of unrealized investments plus realized distributions that get reinvested into the fund). Typically, carry is charged so long as the fund’s value exceeds its high watermark.

High Water Mark (Hurdle Rate)

The highest level of value reached by a portfolio. If a portfolio declines in value, the fund must first achieve sufficient returns to exceed the high watermark before it can once again collect carry.

Private Markets Drawdown Fund Performance Fee Structure

For illustrative purposes only. Source: Goldman Sachs Asset Management as of March 31, 2025.