What are Hedge Funds?

Hedge funds are investment funds that pool capital from investors and invest in a variety of asset classes. They focus on generating absolute returns, as opposed to beating a given benchmark. Hedge funds have the flexibility to use derivatives and “short” securities and can utilize leverage to generate returns. They employ a wide array of strategies including tactical trading, long/short, event driven, multi-strategy, and relative value.

Potential Reasons to Invest

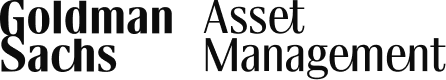

1. Potential for Uncorrelated Returns

Hedge funds can utilize differentiated strategies, including the ability to invest long and short, and flexible mandates, including the use of derivatives to exhibit lower correlation and sensitivity to traditional assets. Hedge funds may seek to generate idiosyncratic returns with low correlations to broad asset classes. As the correlation between equities and fixed income increases, hedge funds can be better poised to capture differentiated returns.

3 Year Rolling Pairwise Correlation

Click here to access data for the line chart listed above.

Source: Goldman Sachs Asset Management as of 2025. The graph above reflects the rolling 3Y correlations over the period shown between (i) monthly total returns of MSCI World and (ii) monthly total returns of Bloomberg US Treasury Total Return Index from 1977 to 2024. reflects the rolling 3Y correlations over the period shown between (i) monthly total returns of 60/40 (60% MSCI World and 40% of Bloomberg US Treasury Total Return Index) and the PivotalPath Composite Index. Past correlations are not indicative of future correlations, which may vary. Diversification does not protect an investor from market risk and does not ensure a profit.

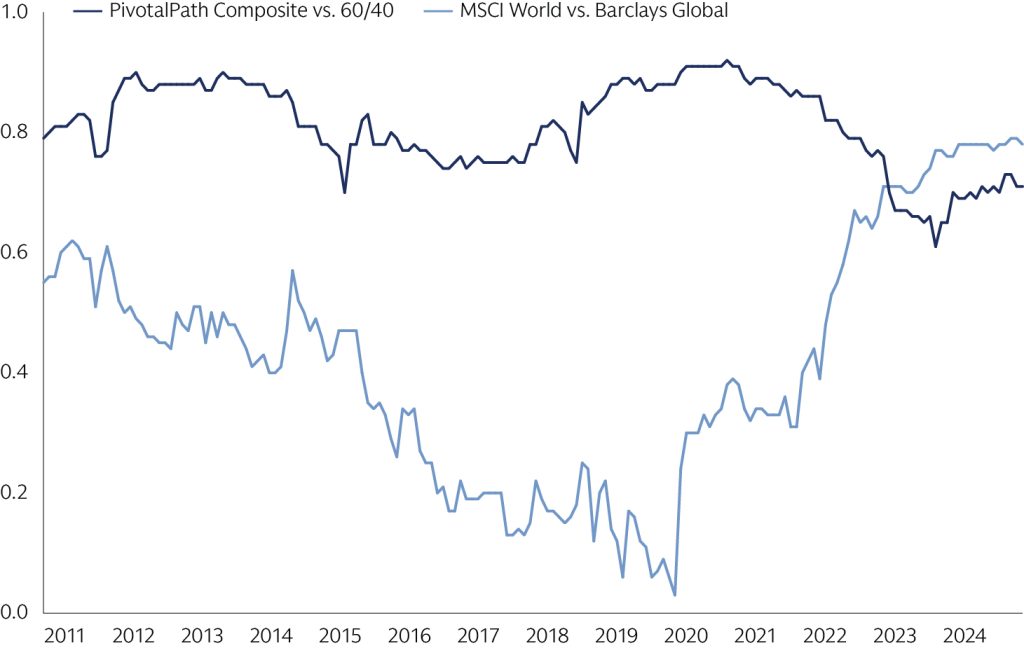

2. Potential Risk Mitigation Attributes

Exposure to hedge funds in an investor portfolio may dampen overall portfolio volatility. We have observed that skill-based strategies are typically more diversifying than market-based strategies, which may provide potential risk mitigation and lower drawdowns through ability to nimbly adjust market exposures. Since hedge funds are unconstrained from benchmarks, they can respond more flexibly to market downturns.

Drawdown: MSCI World vs. PivotalPath Composite Index

Click here to access data for the line chart listed above.

Source: Source: XIG as of November 2024. 1. The graph above reflects drawdown for MSCI World and HFRI FWI from 1994 to present.

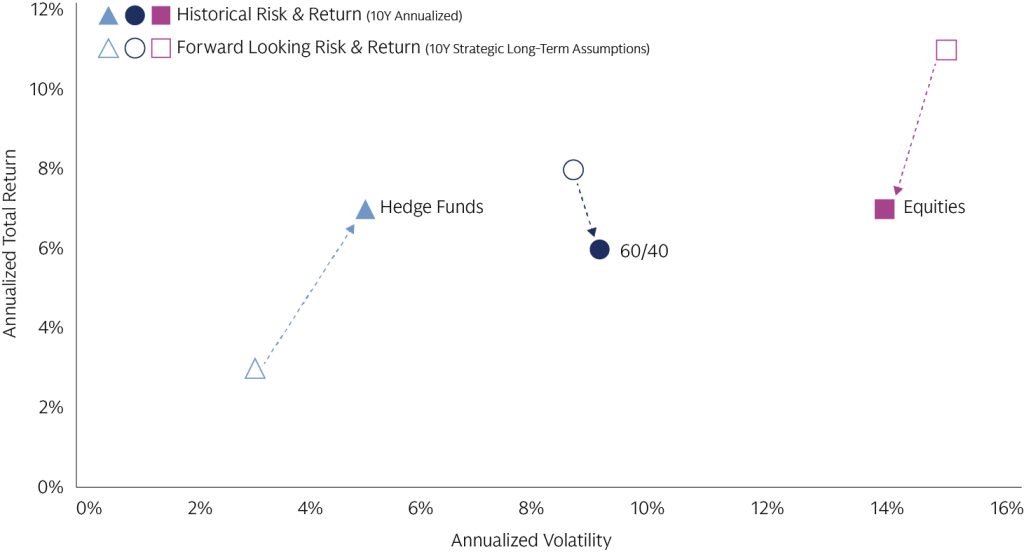

3. Potential Returns for Skill-Based Investors

Hedge funds may provide access to many of the world’s most skillful and talented investors. In the last decade, accommodative monetary policy has resulted in record low interest rates in the US, which in turn supported equity returns. In our view, the next decade is likely to be different from the goldilocks environment of the past, and thus there is an increased need to be active to generate returns. Hedge funds have the ability to take a more active approach than most traditional strategies, by virtue of being able to trade across a wider variety of strategies and instruments, to short assets and use derivatives, and to maintain a higher tracking error to benchmarks than is generally the case in traditional stock and bond strategies. This should magnify the impact of investor skill (positive or negative).

Historical vs. Forward Looking Risk & Return

Click here to access data for the line chart listed above.

Disclosure: This material is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. Source: Goldman Sachs Asset Management. Historical return and risk characteristics shown (2015 –2024) are based on the respective asset allocation and the representative indices’ performance. The returns are gross and do not reflect the deduction of investment advisory fees, which will reduce returns. The returns are based on the respective indices and does not represent performance for any Goldman Sachs product. It is not possible to invest in an unmanaged index. Alpha and tracking error assumptions reflect Multi-Asset Solutions’ estimates for above-average active managers and are based on a historical study of the net-of-fee results of active management. Strategic long-term assumptions are subject to high levels of uncertainty regarding future economic and market factors that may affect future performance. They are hypothetical indications of a broad range of possible returns. All numbers reflect Multi-Asset Solutions’ strategic assumptions as of 12/31/2024. Expected returns are estimates of hypothetical average returns of economic asset classes derived from statistical models. There can be no assurance that these returns can be achieved. Actual returns are likely to vary. Please see additional disclosures. See appendix for Strategic Long-Term Assumptions. For illustrative purposes only. Past performance does not guarantee future results, which may vary.

Hedge funds may be subject to less regulation than other types of pooled investment vehicles such as mutual funds. In addition, hedge funds may have lock-up periods that prevent investors from getting their money back immediately.