What is Real Estate?

Real estate encompasses a wide range of properties and facilities housing and supporting our society. Properties are generally classified by usage type, such as residential, office, industrial, retail, and hospitality. The nature and location of opportunities are evolving as our societies evolve the way we live and work.

Real estate strategies encompass a wide variety of opportunities across the risk and return spectrum. As such, they can offer diversification across return sources, degrees of sensitivity to economic cycles, and a combination of income and long-term growth, depending on the underlying approach.

Potential Reasons to Invest

1. Potential Yield Enhancement, with Inflation Protection

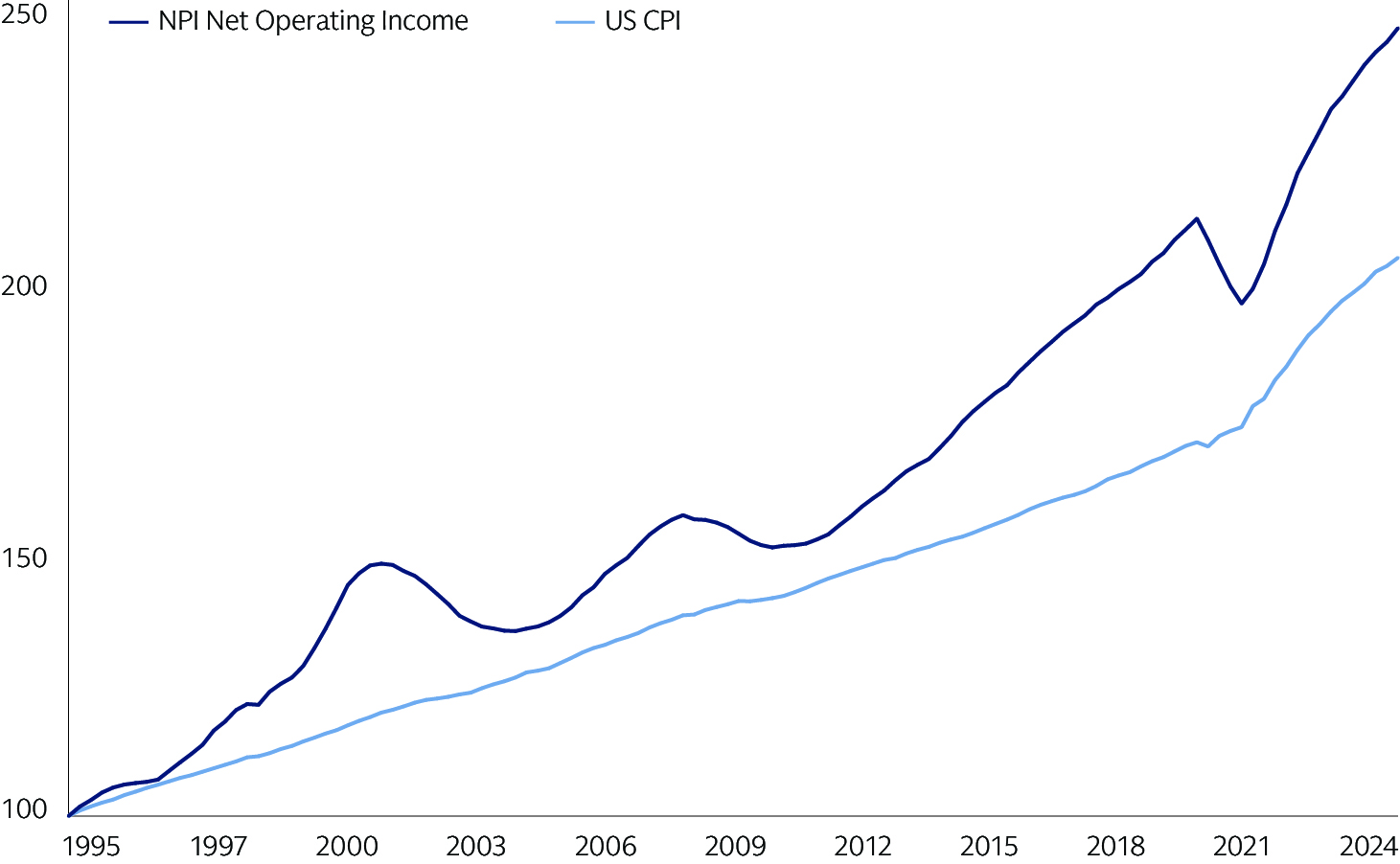

Core real estate has historically served as an attractive source of income, providing yields in excess of stocks and bonds. This yield has outpaced inflation over the past 30 years. Overall rents have kept pace with, or exceeded, broader inflation (but can vary considerably across sectors and markets, based on market-specific supply and demand factors). Commercial real estate asset prices have also historically moved with inflation, given the impact of construction costs (in the form of labor and materials) and changes in land values on replacement costs.

Real Estate Income & Inflation (1995 – 3Q 2024)

Click here to access data for the line chart listed above.

Sources: FRED, NCREIF Property Index (NPI); As of March 31, 2024. Indexed, 1994=100. CPI refers to Consumer Price Index for All Urban Consumers: All Items Less Food and Energy. Past performance does not guarantee future results, which may vary

2. Differentiated Returns

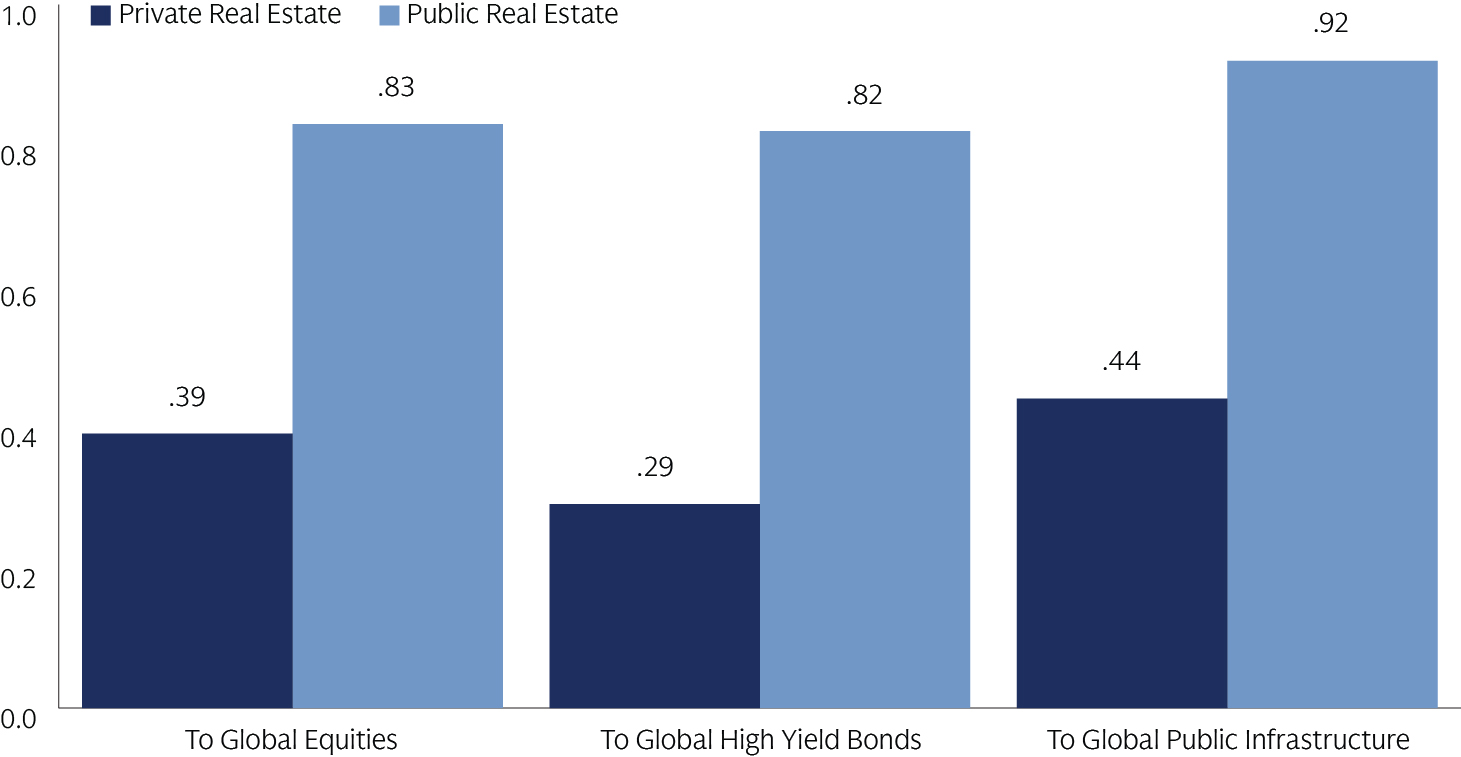

Real estate has the potential to enhance a portfolio’s risk-adjusted return by offering differentiated, less correlated sources of return. Underlying real estate supply and demand drivers, and the structure of underlying leases, introduce market-, sector-, and asset-specific considerations that may help offset some sensitivity to broader economic factors. These dynamics have helped mute correlations to public equity and credit markets – particularly for private real estate. Value-add and opportunistic real estate strategies are primarily the purview of private markets and offer exposures not easily accessed in public markets. Core private market strategies have featured lower correlations than their public counterparts, REITs, whose inclusion in broad equity indices has made them sensitive to broad equity market dynamics.

Real Estate Correlation

Source: Refinitiv. Private real estate index courtesy of Cambridge Associates. Global equities proxied by the MSCI World index, Global High Yield proxied by the Barclays Global HY Index, Public Infrastructure proxied by the FTSE Global Infrastructure Index, Public Real Estate proxied by the FTSE EPRA Nareit index. 15 years of quarterly data through December 2024. Past performance is not indicative of future results.

3. Capitalizing on Secular Megatrends

By its nature, real estate is tied to global demographics and secular megatrends, as well as to their local expressions. As such, we believe segments of the real estate market stand to benefit from demographic, sustainability, technology and geopolitical shifts to support evolving space demands.